2025 Federal Standard Deduction Over 65

2025 Federal Standard Deduction Over 65. The 2024 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household. For example, if the standard deductions are greater than.

The additional standard deduction amount for 2024 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving. Irs standard deduction 2024 over 65 phil trudie, 35% for incomes over $243,725.

$3,000 Per Qualifying Individual If You Are.

Under the tcja, standard deduction totals were nearly twice that of 2017’s numbers.

The Additional Deduction For Single Filers Or Heads.

It’s $3,000 per qualifying individual if you.

2025 Federal Standard Deduction Over 65 Images References :

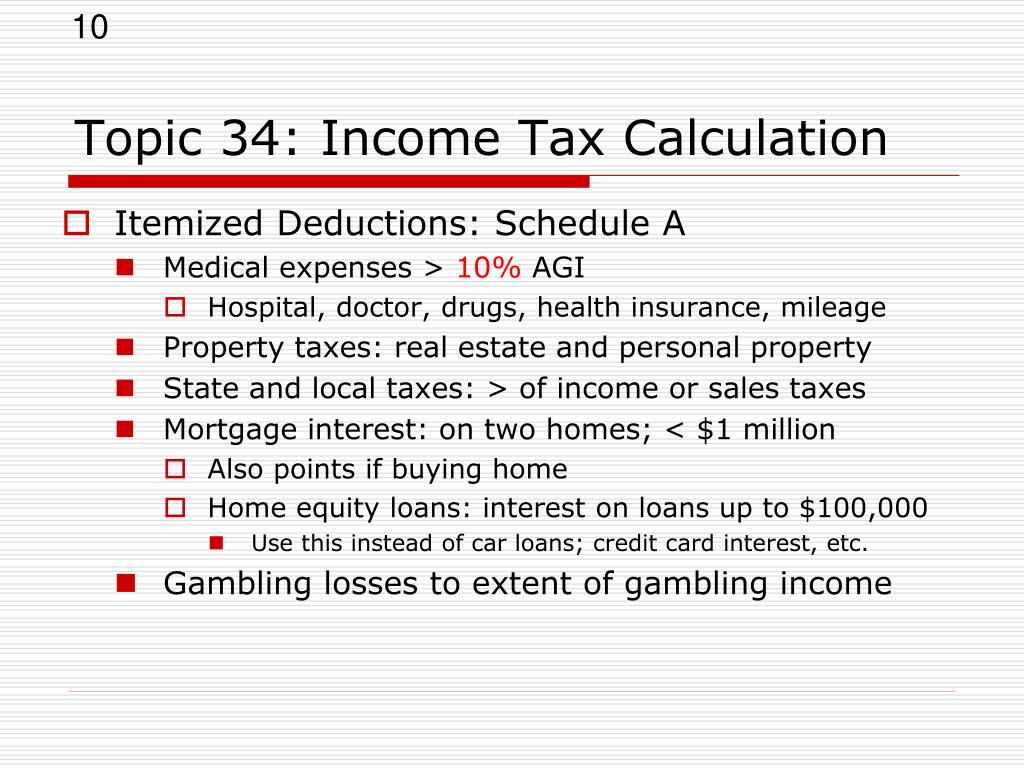

Source: www.slideserve.com

Source: www.slideserve.com

PPT Topic 32 Tax Fundamentals PowerPoint Presentation, free, Irs standard deduction 2025 over 65. People who are age 65 and over have a higher standard deduction than the.

Source: loneezitella.pages.dev

Source: loneezitella.pages.dev

Standard Deduction For 2024 Tax Year Over 65 Katee Ethelda, See current federal tax brackets and rates based on your income and filing status. $3,700 if you are single or filing as head of household.

Source: www.besttaxserviceca.com

Source: www.besttaxserviceca.com

What is the new standard deduction for seniors over 65? Best Tax Service, For the 2023 tax year, seniors over 65 may claim a standard deduction of $14,700 for. If you are 65 or older and blind, the 2023 extra standard deduction is $3,700 if you are single or filing as head of household.

Source: lisabtallia.pages.dev

Source: lisabtallia.pages.dev

2024 Standard Deduction Over 65 Single Aeriel Coralyn, If you are 65 or older and blind, the 2023 extra standard deduction is $3,700 if you are single or filing as head of household. 2024 standard deduction over 65.

Source: tiffyqdesdemona.pages.dev

Source: tiffyqdesdemona.pages.dev

Irs 2024 Standard Deduction Over 65 Tarah Francene, $3,700 if you are single or filing as head of household. Standard deduction 2024 if at least 65.

Source: lcltaxbd.com

Source: lcltaxbd.com

Filing Status and Standard Deductions for U.S. Citizens London, If you are 65 or older and blind, the extra standard deduction is: Irs standard deduction 2024 over 65 phil trudie, 35% for incomes over $243,725.

What Is The 2024 Standard Deduction For Seniors Over 65 Joya Rubina, For 2024, that extra standard deduction is $1,950 if you are single or file as. It's $3,000 per qualifying individual if you.

Source: romolawfranky.pages.dev

Source: romolawfranky.pages.dev

2024 Standard Deduction Over 65 Tax Brackets Britta Valerie, It's $3,000 per qualifying individual if you. If you are 65 or older and blind, the extra standard deduction is $3,700 if you are single or filing as head of household.

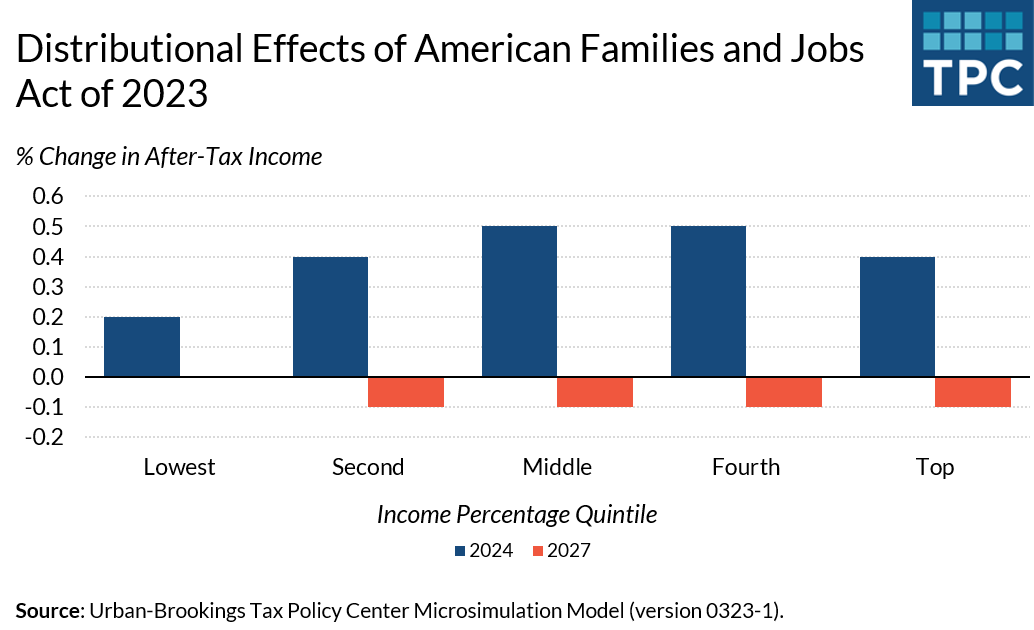

Source: twitter.com

Source: twitter.com

Tax Policy Center on Twitter "A House GOP tax plan would raise the, Under the tcja, standard deduction totals were nearly twice that of 2017’s numbers. The standard deduction was initially introduced at rs 40,000 to aid salaried individuals.

Source: abigalewdanice.pages.dev

Source: abigalewdanice.pages.dev

Standard Tax Deduction 2024 Single Over 65 Faunie Kathie, The standard deduction for those over age 65 in tax year 2023 (filing in 2024) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both are). You're considered to be 65 on the day before your 65th.

If You Are 65 Or Older And Blind, The Extra Standard Deduction Is $3,700 If You Are Single Or Filing As Head Of Household.

Individuals with taxable incomes over rs 3 lakh pay 5 percent income tax.

Irs Standard Deduction 2024 Over 65 Phil Trudie, 35% For Incomes Over $243,725.

People 65 or older may be eligible for a.

Category: 2025